-

The Global Do-it-Yourself Home Improvement Retailing Market is expected to grow by $186.33 mn during 2023-2027, accelerating at a CAGR of 4.41% during the forec…

ReportLinker Global Do-it-Yourself Home Improvement Retailing Market 2023-2027 The analyst has been monitoring the do-it-yourself home improvement retailing market and it is poised to grow by $186. New York, Nov. 21, 2022 (GLOBE NEWSWIRE) — Reportlinker.com announces the release of the report “Global Do-it-Yourself Home Improvement Retailing Market 2023-2027” – https://www.reportlinker.com/p06363900/?utm_source=GNW 33 mn during 2023-2027, accelerating at a CAGR of 4.41% during the forecast period. Our report on the do-it-yourself home improvement retailing market provides a holistic analysis, market size and forecast, trends, growth drivers, and challenges, as well as vendor analysis covering around 25 vendors.The report offers an up-to-date analysis regarding the current global market scenario, the latest trends…

-

Home Depot and Lowe’s are booming in a housing market bust

A home improvement contractor works on a house in Cambridge, Massachusetts. Suzanne Kreiter | The Boston Globe | Getty Images As the U.S. housing market falls hard from its pandemic-driven highs, home improvement retailers like Home Depot and Lowe’s don’t seem to be feeling the same pain. In fact, they’re faring better than expected. While homebuilding and home remodeling are integrally connected, the market forces behind each can be different, and that’s what’s happening now. related investing news Raymond James downgrades Home Depot, says there are challenges ahead despite solid earnings report Home Depot and Lowe’s reported strong quarterly earnings Tuesday and Wednesday, respectively. Lowe’s stock rose 3% Wednesday. Executives…

-

Steady Second-Home Market Extends Hawaii’s Real Estate Boom

Year-to-date statewide high-end sales in Hawaii are outpacing 2021 in both number of transactions … [+] and total dollar value, according to Hawai’i Life. Hawai’i Life In an already diverse real estate landscape, there is perhaps no market more unique in the United States than Hawaii. Fueled by wealthy out-of-state buyers, the demand for second-home properties outpaces any other part of the country. According to Hawaii’s chief economist, roughly a quarter of Hawaii’s homes were purchased by non-residents. Large land offerings and priceless oceanfront properties are coming to market on each of the major … [+] islands. Hawai’i Life This continued interest in Hawaii’s real estate by mainlanders and foreign…

-

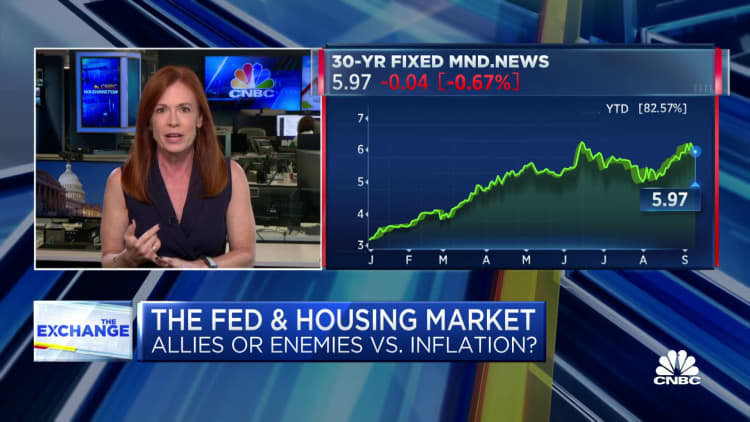

Confused about the housing market? Here’s what’s happening

The slowdown in the otherwise red-hot housing boom has been stunningly swift. The U.S. housing market surged during the pandemic as homebound people sought new places to live, boosted by record-low interest rates. Now, real estate agents who once reported lines of buyers outside open houses and bidding wars on the back deck say homes are sitting longer and sellers are being forced to lower their sights. That has both potential buyers and sellers wondering where they stand. “As recession concerns weigh on consumer outlooks, our survey shows uncertainty has made its way into the minds of many buyers,” said Danielle Hale, chief economist at Realtor.com. Here are the major…

-

The No. 1 emerging real-estate market in America is also the RV capital of the world

The pandemic spurred millions of Americans to abandon city life, fleeing to the ‘burbs. A new report highlights a novel destination for would-be homeowners to consider: The R.V. capital of the world. The Wall Street Journal/Realtor.com Emerging Housing Markets Index, released Tuesday, ranked Elkhart-Goshen, Ind., as the top housing market. (Realtor.com is owned by the same parent company as MarketWatch.) The northern Indiana city is known to produce as much as 80% of recreational vehicles globally, with manufacturers headquartered in the city. These include companies like Jayco, Keystone, and more. The metro area has one of the lowest unemployment rates compared to others on the index, at 1.6%, the report said.…

-

How the sale of a piece of Flatiron Park could impact its future and Boulder’s real estate market

Four months ago, the already-hot Boulder commercial real estate market saw what could be one of its most consequential deals yet, when BioMed Realty LLC purchased a 1-million-square-foot portfolio in the Flatiron Park business campus — located east of 55th Street between Arapahoe Avenue and Pearl Parkway — for $625 million. That was the richest commercial real estate sale in Colorado history, $232 million more than the previous record. But the sale carries significance far greater than the sticker shock of the price, said Becky Callan Gamble, president of commercial brokerage Dean Callan & Co. BioMed is one of the largest life-sciences real estate firms in the country — it…