-

China Is Finally Trying to Fix Its Housing Crisis

More than a year after one of China’s biggest real estate developers began to collapse, trouble has rippled through cities across the country. Dozens of other developers have also missed debt payments, the sale of new homes has plunged and construction cranes have come to a standstill at many sites. This week the Chinese government, which until now has stayed largely on the sidelines of the country’s housing crash, has taken its most forceful steps so far to try to minimize the damage from the turmoil that has enveloped China Evergrande Group, the world’s most heavily indebted developer, and many of its competitors. Real estate development plays an outsize role…

-

Home Depot and Lowe’s are booming in a housing market bust

A home improvement contractor works on a house in Cambridge, Massachusetts. Suzanne Kreiter | The Boston Globe | Getty Images As the U.S. housing market falls hard from its pandemic-driven highs, home improvement retailers like Home Depot and Lowe’s don’t seem to be feeling the same pain. In fact, they’re faring better than expected. While homebuilding and home remodeling are integrally connected, the market forces behind each can be different, and that’s what’s happening now. related investing news Raymond James downgrades Home Depot, says there are challenges ahead despite solid earnings report Home Depot and Lowe’s reported strong quarterly earnings Tuesday and Wednesday, respectively. Lowe’s stock rose 3% Wednesday. Executives…

-

U.S. will turn into a buyers’ housing marke in 2023, most experts say. Here’s where you’ll see the biggest declines.

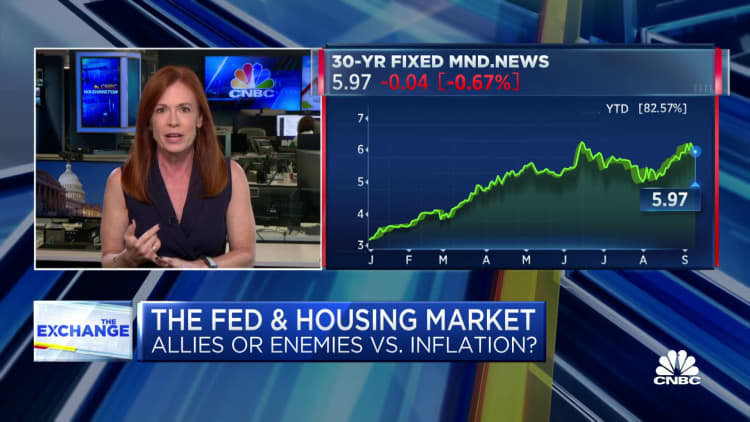

Frustrated by the housing market? Housing experts say they’re expecting the market to tip back into buyers’ court by 2023, according to a new report. Mortgage rates are approaching 7%, but home prices are only slowly coming back down and inventory is still tight compared to pre-pandemic levels. Still, the U.S. housing market will shift in favor of home buyers by the end of 2023, 44% of 107 economists and housing experts polled by real-estate company Zillow for its Home Price Expectations Survey said. And 12% of these experts believed that shift will happen sooner — that is, this year. Yet roughly 45% of experts surveyed by Zillow say buyers…

-

These 210 housing markets are now vulnerable to 20%-25% home price declines, finds latest Moody’s downgrade

Favorable millennial demographics. Tight housing inventory. Low unemployment. That’s why housing bulls said the Pandemic Housing Boom had more room to run. Moody’s Analytics chief economist Mark Zandi, of course, disagreed. Back in May, Zandi came to Fortune with a bold proclamation: The Pandemic Housing Boom had peaked and we were entering into a “housing correction.” A housing correction being a period where the housing market—which got priced to 3% mortgage rates—would work towards equilibrium. It’d see home sales volumes fall sharply. It’d also, Zandi said, put much of the nation at risk of a home price corrections. Fast forward to September, and it looks like Zandi’s housing correction call…

-

Confused about the housing market? Here’s what’s happening

The slowdown in the otherwise red-hot housing boom has been stunningly swift. The U.S. housing market surged during the pandemic as homebound people sought new places to live, boosted by record-low interest rates. Now, real estate agents who once reported lines of buyers outside open houses and bidding wars on the back deck say homes are sitting longer and sellers are being forced to lower their sights. That has both potential buyers and sellers wondering where they stand. “As recession concerns weigh on consumer outlooks, our survey shows uncertainty has made its way into the minds of many buyers,” said Danielle Hale, chief economist at Realtor.com. Here are the major…

-

Map: How fast sellers are slashing home prices in America’s 97 biggest housing markets

The Pandemic Housing Boom saw U.S. home prices spike an unprecedented 43% in just over two years. But that’s over now: Spiked mortgage rates have pushed the U.S. housing market into a sharp slowdown that could threaten some of those gains. Some firms—including John Burns Real Estate Consulting, Zonda, and Zelman & Associates—are already predicting that U.S. home prices in 2023 will post their first year-over-year decline of the post–Great Financial Crisis era. In a sharp housing downturn scenario, Fitch Ratings thinks a 10% to 15% national home price decline is possible. Not everyone agrees. Goldman Sachs and Zillow predict that U.S. home prices will rise another 1.8% and 2.4%,…